SNAP Credit

Funding Solutions

for Business Owners

When The Banks Say NO We find ways to get you the money you need!

Business Owners

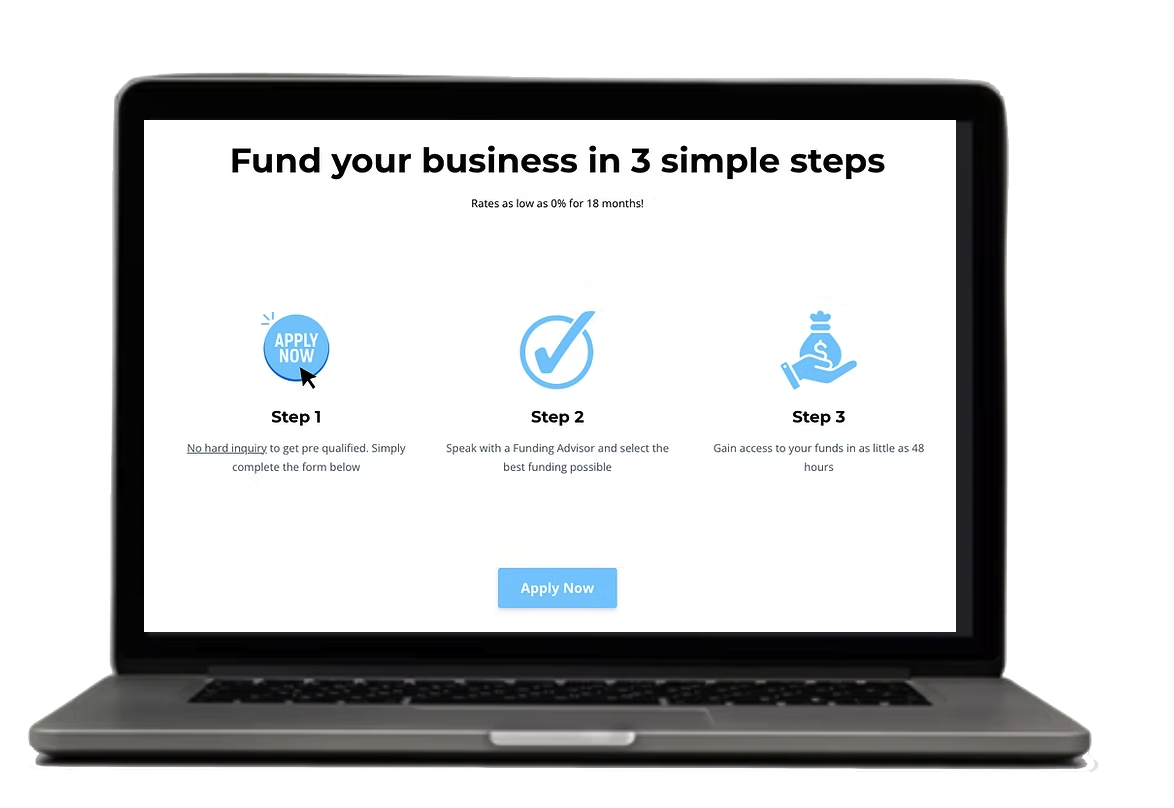

Access Your Funding In 3 Simple Steps

No Negative Impact to Your Credit to See if You Pre Qualify

What Sets

Us Apart

No Credit Impact to Pre-Qualify

We provide a free pre-approval estimate with no negative impact to your credit.

Best Funding for your Business

Our clients get matched with the best possible funding across the entire funding marketplace.

Credit Education

We provide startups access to our entrepreneur education platform.

Save Money on Interest

We help clients save money by moving high-interest debts to new 0% accounts.

Funding for Business Owners in All 50 States

We can assist clients with finding their best possible options in all 50 states.

Marketplace

Our marketplace of lenders gives you the confidence that you are accessing the

best funding you can qualify for

Business Line of Credit

0% Business Credit Card

Personal Term Loan

Business Term Loan

SBA Loans

Disclaimer: We may receive compensation from lenders if you fund through our links. We do not allow this to affect our recommendations. Actual funding amounts and rates vary and are not guaranteed. Approval depends on personal and/or business creditworthiness and lender criteria.

Startup Funding 0% Business Credit Card Stacking

Secure multiple 0% accounts to launch your business.

Amount:

Up to $150K

Time Frame:

2–3 Weeks

Rate:

0% up to 18 Months

Example:

$10K balance = $200/month

Startup Funding Personal Loans

Use for credit payoff, score boosting, and qualification for 0% funding.

Amount:

Up to $250K

Time Frame:

3–10 Days

Rate:

From 5.99%+

Example:

$20K = $450/month over 5 years

Business Line of Credit

Only pay for what you use with this revolving line.

Amount: Up to $500K

Time Frame: As soon as 3 Days

Rate: As low as 8%

Term: 1–3 Years

Short Term Business Loan (MCA)

Quick access for urgent business expenses.

Amount: Up to $500K

Time Frame: As soon as 24 Hours

Rate: 1.20 Factor Rate

Term: 6–24 Months (Daily/Weekly Payments)

Equipment Funding

Financing for all industry equipment—even airplanes.

Amount: Up to $50M

Time Frame: 1–3 Weeks

Rate: As low as 7.99%

Term: Up to 5 Years

SBA Loans

Efficient and streamlined SBA loan process. Secure the capital you need today and propel your business forward.

Amount: Up to $500K

Time Frame: 45-90 Days

Rate: Prime +3.75%

Term: 10 Years

Commercial Real Estate

Invest in real estate with as little as 20–30% cash down.

Amount: Up to $100M

Time Frame: 1–3 Months

Rate: As low as 4%

Term: Up to 30 Years

Disclaimer: We may receive compensation from lenders if you choose to fund through our links; however, this never influences our recommendations. Funding amounts, rates, and approvals vary and are not guaranteed. Approval is based on personal and/or business creditworthiness and lender criteria. Submitting an application will not impact your personal credit score. If you accept a funding offer, some lenders may require a hard credit inquiry. Snap Credit Fix is not a direct lender and does not make credit decisions. All approvals are at the discretion of the bank or issuer. Nothing here constitutes legal, tax, or financial advice. Please consult a licensed professional for personalized guidance.

Here's What

Our Clients Think

"The guys at will do exactly what they say they’ll do, and they do it with a smile. Very professional, and the best! Thanks for every."

-Jeff Horn

"They delivered painless funding for my business more than what I have requested."

-Mr. David A

"They were great to work with. A big help. If you need help getting business funding give them a call."

-James Craig

Frequently Asked Questions

Q. Will applying for a funding pre-approval with SNAP Credit affect my credit score?

No, our system performs a soft credit check to provide you with a pre-approval estimate—this has zero impact on your credit score. However, if you choose to move forward with funding, certain lenders may perform a hard credit inquiry with your consent.

Q. Do I need to have an established business or legal entity to work with you?

No, you don’t. Many of our clients are still in the idea or startup phase and haven’t yet formed a legal entity.

Q. Does SNAP Credit provide personal funding as well?

Yes, we help clients access both personal and business funding options.

Q. Is SNAP Credit available nationwide?

Yes, we provide funding services in all 50 U.S. states.

Q. What types of funding programs do you offer?

We provide a full range of funding options—including 0% interest personal cards, 0% business credit cards, business lines of credit, no-collateral 5-year loans, equipment financing, and SBA loans

Q. Does SNAP Credit provide personal funding as well?

Yes, we help clients access both personal and business funding options.